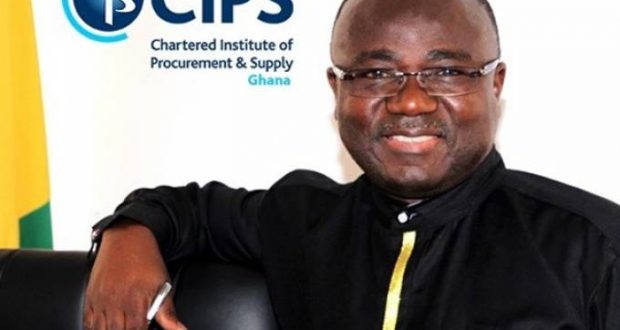

Chief Executive of PPA, Agyenim Boateng

The Public Procurement Authority (PPA) has said it will also investigate the Social Security National Insurance Trust (SSNIT) over the $72 million digitization deal.

The Chief Executive of the PPA, Agyenim Boateng Adjei told Citi News in an interview that his outfit is awaiting the report by PricewaterhouseCoopers (PWC) before commencing the investigations.

According to him, the report will serve as a guide in ascertaining the procurement processes that led to the company pumping millions of dollars into the project.

SSNIT is currently being investigated by the Economic and Organized Crime Office (EOCO) for blowing $72 million on procuring and installing a software and other hardware systems known as the Operational Business Suite (OBS) in a bid to digitize the Trust.

The cost, which was originally $34 million, later ballooned to $66 million and then to $72 million due to maintenance and additional infrastructure.

The Board Chairman of SSNIT, Kwame Addo Kufuor in an earlier interview with Citi News said about 15 people had already appeared before EOCO as witnesses in the matter.

SSNIT shares dip in UMB

In another development, it has emerged that SSNIT’s 80% shares in then Merchant Bank [Now UMB] had reduced to less than 5%.

It is recalled that following debt troubles in 2013, Merchant bank was acquired by Fortiz, a Private Equity Fund.

Fortiz paid GH¢90 million for a majority stake in the bank with the understanding that an additional injection of GHS 50 million would be injected within a six month period.

The amount gave them a controlling stake of 90 per cent in the bank, leaving the Minority 10 per cent to the country’s pensions fund manager, SSNIT and SIC Life Limited.

But after an initial payment of GHS 10 million to UMB as equity capital by Fortiz, it entered into an unsecured, subordinated debt instrument facility, referred to as a convertible loan with the bank, through which an additional GHC 40 was invested into UMB.

Soon after it was concluded, the loan was converted into equity, in accordance with the Term sheet as approved by the AGM.

This led to SSNIT shares reducing from 8.96 to 4.43% of the company, valued at GHS 2,565, 537, while that of SIC life reduced from 1.04% to 0.51%, valued at GHS 297, 780.

–

By: Fred Djabanor/citifmonline.com/Ghana

No comments:

Post a Comment